www tax ny gov online star program

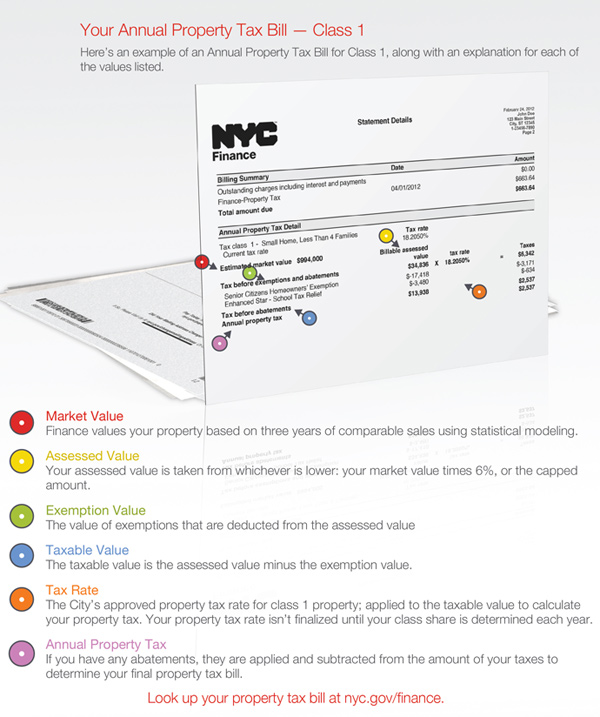

All New Yorkers who own or have life use and live in their home are eligible for the STAR exemption on their primary residence. All New Yorkers who own and live in their one two or three family home condominium cooperative apartment manufactured home or farm dwelling are eligible for a STAR exemption on their primary residence.

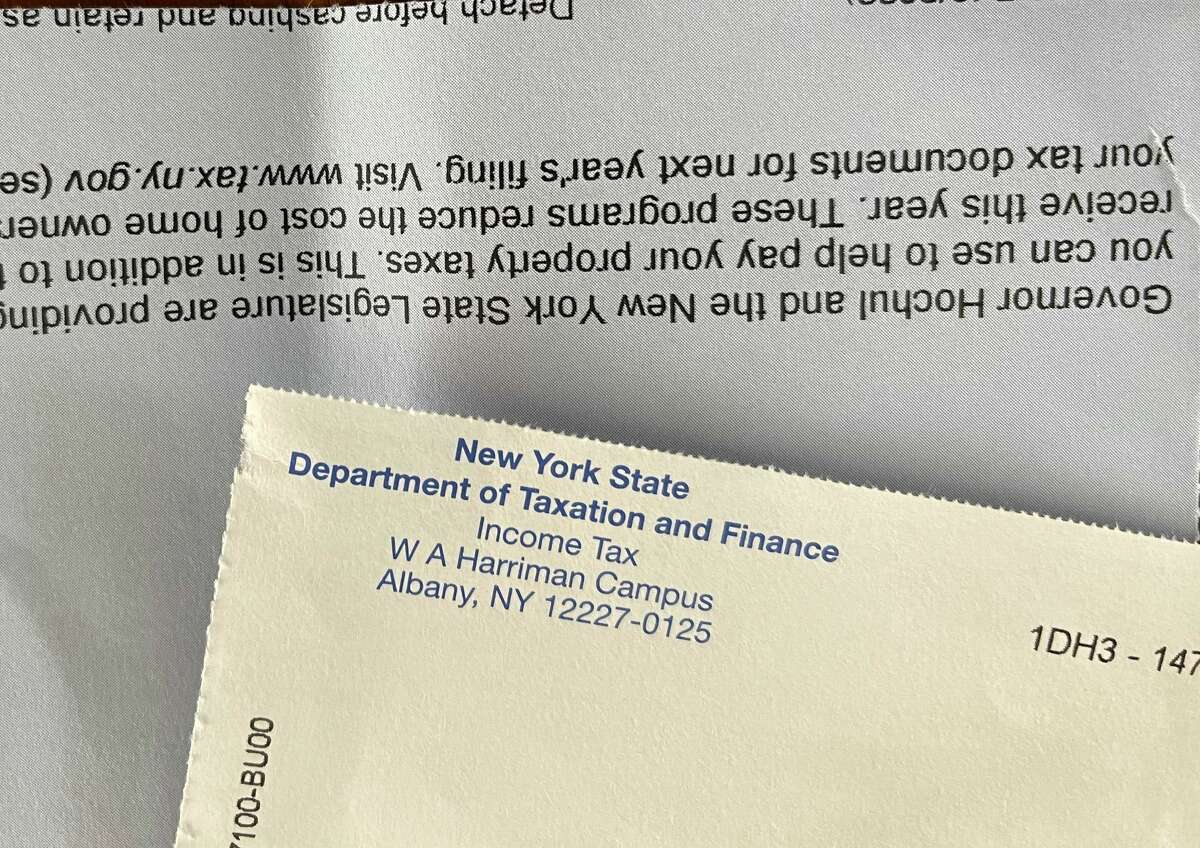

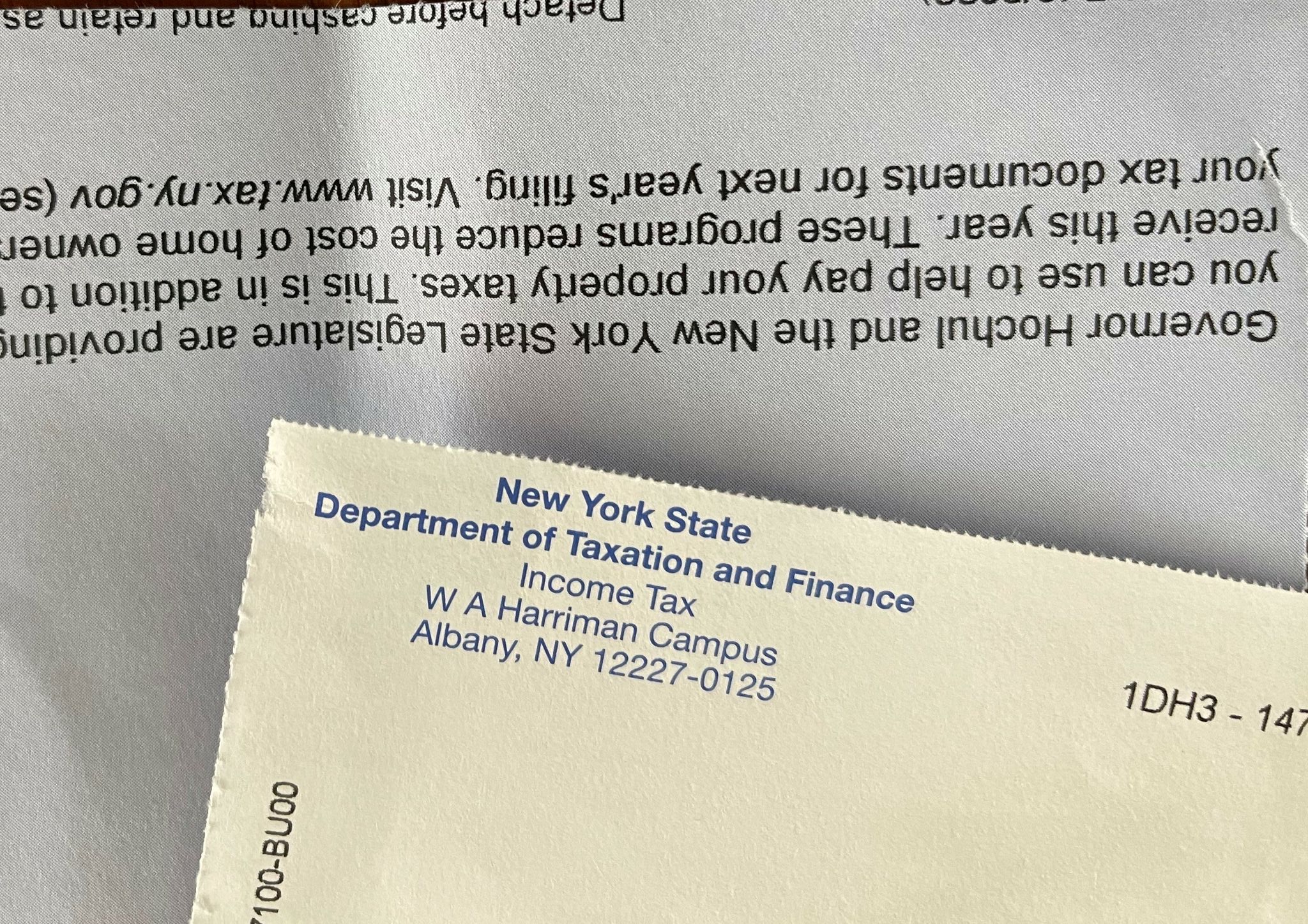

Homeowner Tax Rebate Credit Check Lookup

If your income is greater than 250000 and less than or equal to 500000 you can register online for New York State STAR tax credit or by calling 518-457-2036.

. We changed the login link for Online Services. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

We can send you a link to this page to help you get back to it when youre ready. Enter the security code displayed below and then select Continue. Come back to it later.

The following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program. Department of Taxation and Finance STAR Credit Program Reports If you are receiving this message you have either attempted to use a bookmark without.

Enter the security code displayed below and then select Continue. The following security code is necessary to prevent unauthorized use of this web site. You may receive a larger benefit with the credit as the amount of the STAR credit will increase in the future but the value of the exemption will not.

If you are using a screen reading program. There are two parts to the STAR property tax exemption Enhanced STAR and Basic STAR. STAR is New Yorks School Tax Relief Program that provides a partial exemption from school property taxes.

Below you can find a guide to frequently asked questions about the program. To learn more visit wwwtaxnygovstar or contact the New York State Department of Taxation and Finance at. If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518-457-2036 from.

We recommend you replace any bookmarks to this. Visit wwwtaxnygovonline and select Log in to access your account. Text More ways to get help with this program Visit the website.

New York State Office for the Aging 2 Empire State Plaza Albany New York 12223-1251 Telephone. STAR is New York States School Tax Relief Program that provides tax exemptions to New York homeowners. STAR Check Delivery Schedule.

Mobile Manufactured Homes Homes And Community Renewal

New York State Secure Choice Savings Program Board

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Tioga Opportunities Inc

Governor Hochul Launches Health Care Worker Bonus Program Governor Kathy Hochul

Receiver Of Taxes Town Of Oyster Bay

The School Tax Relief Star Program Faq Ny State Senate

We Are An Authorized Irs E File Provider Call Us Today To Get Your Taxes Prepared And Your Refund Asap 40 Tax Lawyer Certified Public Accountant Tax Services

210m Upgrade For Grand Central S Subway Unveiled

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WFAEAJ2QQZOGHIVDQCZ7FX4DFY.jpg)

New York Governor Hochul Declares State Emergency Over Monkeypox Reuters

New York Property Owners Getting Rebate Checks Months Early

New York Property Owners Getting Rebate Checks Months Early

Find 990 Series Forms And Annual Filing Requirements For Tax Exempt Organizations Private Foundation Internal Revenue Service Filing Taxes